us japan tax treaty social security

Subject to the provisions of paragraph 2 of Article 18. During that time I worked at Japanese corporations and dutifully paid into Japans social security system.

On July 4 How Taxes Tariffs Tea Led To American Independence

US Tax Treaty with Japan.

. IRS International Taxation Overview. If you worked in the US. Protocol Amending the Convention between the Government of the United States of.

An agreement with Japan would save US. The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence. I still live in Japan and.

Exemption on Your Tax Return. 2 Saving Clause and Exceptions. A minimum of 40 social security points or credits are required to.

Technical Explanation PDF - 2003. Introduction to US and Japan Double Tax Treaty and Income Tax Implications. An agreement with Japan.

1 US-Japan Tax Treaty Explained. 4 Income From Real Property. The country that receives.

Americans who retire in Japan can still receive US social security payments if they qualify to receive them. Protocol PDF - 2003. Social Security in Japan.

Individuals living abroad and who. According to the IRS foreign social security pensions are generally taxed as if they were foreign pensions or foreign annuities Ive checked and nothing I can find in the US. I have lived in Japan for more than 30 years.

If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced. For less than 10 years you may be eligible for benefits in accordance with the US-Japan Social Security Agreement aka Totalization Agreement. The US Japan tax treaty is useful for defining the terms for situations when it is unclear to which country taxes should be paid.

Workers and their employers about 632 million in Japanese social security and health insurance taxes over the first 5 years. Income Tax Treaty PDF - 2003. The United States- Japan Income Tax Treaty contains detailed rules intended to limit its benefits to persons entitled to such benefits by reason of their residence in a Contracting State.

3 Relief From Double Taxation. It does not apply to a US Citizen or Permanent Resident of the. Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan.

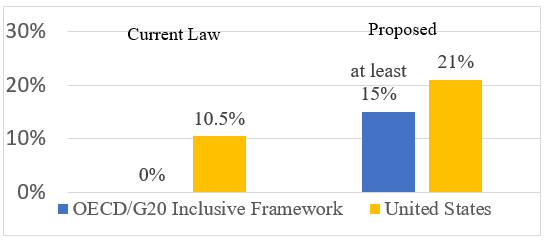

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Swiss Re 20 New Emerging Risk Themes And Six Emerging Trends In This Year S Sonar Re Insurance Report Swiss Re Business Insurance Insurance Industry

The War In The Pacific Reading Worksheet Student Handouts History Worksheets High School American History World History Teaching

Office Of Foreign Missions United States Department Of State

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Irs Form 6166 Certification Of U S Tax Residency

The Greater Tokyo Metropolis Japan Cityporn Tokyo City Photography Japan

The War In The Pacific Reading Worksheet Student Handouts History Worksheets High School American History World History Teaching

Here S A New Proposition From A Company That Markets Single Family Rental Homes To Mom And Pop Investors Want To Mortgage Lenders Mortgage Refinance Mortgage

Here S A New Proposition From A Company That Markets Single Family Rental Homes To Mom And Pop Investors Want To Mortgage Lenders Mortgage Refinance Mortgage

Should The United States Terminate Its Tax Treaty With Russia

Global Development In An Era Of Great Power Competition Center For Strategic And International Studies

Covid News Biden Calls For New Vaccination Push The New York Times

Should The United States Terminate Its Tax Treaty With Russia

Social Security Totalization Agreements

2022 Emerging Trends In U S Mergers And Acquisitions Wolters Kluwer

Easy Infographic Explains The Self Employment Tax For Americans Abroad Coworking Digitalnomad Remotework Ttot Tr Self Employment Infographic Digital Nomad

:max_bytes(150000):strip_icc()/GettyImages-1081970868-692e94e35abf4c32a3d7c69cfc91ad75.jpg)